How Much Money Is There In the World?

They don't want you to know the truth

How much money is there in the world?

You’d think the answer would be pretty straightforward.

Can’t we just add up all the euros, U.S. dollars, British pounds, Swiss francs, Chinese yuan, Japanese yen, etc?

Oh ye of too much faith!

No, no.

That would make sense.

The greedy folks who create money — bankers — would never let it be so simple. (More on why, later.)

A veil of purposefully convoluted complication keeps the sheeple believing the high priests of finance are a superior order to the rest of us.

Today, I want to help you understand how the money scam actually works, and see if we can’t find out how much money there actually is in this big bad world.

The global money supply consists of five different groupings of money — M0, M1, M2, M3, and in some countries, M4.

M0

M-zero is what most people think money is:

Paper money (called currency notes)

Metal money (called coins)

If only it were so simple.

In modern money creation, physical currency notes and coins are a tiny fraction of the total money supply.

M0 also includes bank reserves, which are a sort of neo-money that banks have to keep in their reserve accounts at their country’s central bank.

M0 is the most liquid form of money, and is sometimes called “high-powered money” because it’s the monetary base on which banks can rob us blind by inflating the money supply. None of the following types of money can be created without M0.

M1

M1 includes everything in M0, plus:

Demand deposits — funds held in checking accounts that can be withdrawn on demand without any advance notice

Traveler’s checks, Negotiable Order of Withdrawal (NOW) Accounts, Automatic Transfer Service (ATS) Accounts, Credit Union Share Draft Accounts, and Demand Deposits at Other Financial Institutions such as your Paypal balance or Stripe account.

Basically, M1 is real physical money, fake bank reserves, and all the other forms of money that can be quickly liquidated into cash.

M1 is sometimes called “narrow money” because it only contains highly liquid types of money.

M2

Here’s where things start to get extra-spicy.

M2 includes everything in M0 and M1, plus — listen to this nonsense word — near-money assets.

Near-money assets are things like:

savings accounts

small time deposits (certificates of deposit)

money market accounts and money market funds

Repurchase/repo agreements (short-term loans for dealers to sell government securities and buy them back later)

Eurodollars (sketchy U.S. dollar-denominated deposits held in banks outside the United States, which are not subject to U.S. banking regulations)

Marketable securities (T-bills, commercial paper, municipal notes, short-term corporate bonds, foreign currency deposits, etc.)

M2 can still be converted into cash pretty easily, which is why M2 is the most widely accepted measure of a country’s money supply.

M3

Now we’re heading into the realm of dark money.

M3 is so shady that the Federal Reserve cartel doesn’t even publish M3 totals anymore.

M3 includes everything in M0, M1, and M2, plus even less liquid assets that aren’t used for daily transactions:

large time deposits (over $100k)

Certificates of deposit (CDs) over a certain amount

institutional money market funds (investment funds for huge institutional investors like corporations and pension funds, that invest in Treasury bills, commercial paper, and certificates of deposit)

For most countries (like America), M3 is the broadest measure of the money supply, which is why it’s sometimes known as “broad money.”

M4

While the U.S. doesn’t publish M3 figures anymore, most countries don’t even bother to calculate M4.

Only wildly over-financialized countries like the United Kingdom keep track of M4, but it’s a handy metric if you care about the truth and want to know how wildly overinflated your country’s money supply truly is.

Unfortunately, the U.K. doesn’t define M1, M2, or M3, so it’s difficult to isolate which types of money are properly M4 versus lower-tier. But basically, M4 represents the broadest measure of money in circulation within an economy.

M4 includes everything in M0, M1, M2, and M3, plus:

Net transit items

Inter-MFI reporting differences

Long-term deposits with MFIs (beyond two years)

Private-sector wholesale bank and building society deposits

Long-term paper issued by MFIs (over five years)

Holdings of commodities by MFIs

Investments in MFIs (equities and long-term debt)

Fixed assets held by MFIs

Accrued receivables of MFIs

As you can see, at this point, things are just getting plain stupid.

TLDR: M4 is the broadest money. M4 is all the money.

Define “money supply”

By now, you’ve probably spotted the problem:

Our quest today is to figure out how much money there is in the world, but as you can see, there is no standard global definition for M0, M1, M2, M3, and M4.

Can you believe it’s 2025 and there is no global definition of “money supply?”

It’s almost like bankers don’t want us to know how much wealth they’ve stolen from us by creating money out of thin air.

So how much dang money is there in the world?

We have no idea.

No one does.

Because rich, powerful elites are purposefully not keeping track.

Best estimates?

M0: U$20ish trillion

M1: U$65ish trillion

M2: U$130ish trillion

M3: U$150ish trillion

M4: U$200ish trillion

But these numbers could be off by tens of trillions of dollars.

(For those interested, total global wealth is ~$500 trillion, total global debt is ~$340 trillion, and the notional value of all outstanding derivatives could be over $1 quadrillion.)

We need to know how much money there actually is

Here’s why it would be nice to know the true global money supply:

Because the rate of money supply inflation directly affects price inflation — the cost of your food, fuel, energy, clothes, housing, everything.

My big question is:

At what compound annual growth rate (CAGR) is the global money supply increasing?

Best estimates: At least 5.3% globally.

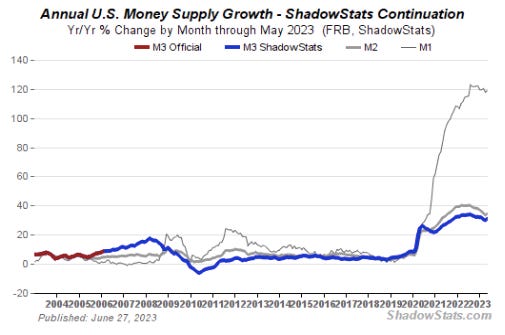

Here’s what the true U.S. money supply looks like:

Meaning your government is lying to you about inflation.

By creating debt-based interest-bearing money out of thin air, banks are literally stealing $10+ trillion in real wealth from us every year.

How to fix the corrupt global money supply

1.) First, we need a global definition of money supply and a way to calculate it in real-time.

2.) We must jubilee all debt to flush the cancer out of our economic system, otherwise the compounding interest payments with destroy our civilization. It’s high time we had a clean slate.

3.) We must abolish fractional reserve banking and ban banks from inflating our money supply by creating money out of thin air.

From now on, banks must keep 100% of deposits in reserve and be unlimited in liability. Banks could lend their own money, but not create new debt-based interest-bearing money.

(Even uber-capitalist Milton Friedman wanted to end the Fed and fractional reserve banking.)

4.) Nations must democratically create debt-free sovereign money and lend it interest-free to states, counties, cities, and community groups to create new assets and explode local prosperity.

This would end joblessness, homelessness, and the boom-and-bust market cycle of bubbles and crashes.

(Call me crazy, but a democracy’s monetary policy should be democratically decided. The fact that this is a contentious statement gives you an idea of how much the power elite hate democracy.)

5.) Politicians must be restricted from inflating the money supply faster than the rate of new asset creation, under pain of lifelong imprisonment in a tickle dungeon playing inane TikTok videos 24/7.

Better that than letting politicians and their elite backers torture the masses with inflation.

When the money supply increases at the same rate as the asset supply, prices stay stable:

10 dollars, 10 houses = 1 dollar per house.

20 dollars, 20 houses = 1 dollar per house.

But when the money supply increases faster than the asset supply, prices rise:

20 dollars, 10 houses = 2 dollars per house.

Ideally, we’d increase the asset supply at a far faster rate than the money supply, so we can strengthen the dollar and regain our stolen purchasing power:

10 dollars, 20 houses = 50 cents per house.

People should be rewarded for working and saving, not brutally punished by inflation.

How much money is there in the world?

Too much.

And not enough.

There’s too much interest-bearing debt-money being created out of thin air by banks and lent to parasite investors to bid up the prices of the things you need to stay alive.

There’s not nearly enough debt-free interest-free money being created democratically to invest in creating hundreds of trillions in new assets every year to boost prosperity to every community on earth.

We need a generation of leaders to destroy the money-creation system that has plunged our world into $340 trillion in the past fifty years, and implement the proven system to reverse a stolen half-century of wealth for all.

PS — Here’s a recent lecture I gave entitled A Revival and a Riot: A Tale of Two Economies

I also sat down for an interview with my dear friend Matt to discuss my new book on the devil and much more. Enjoy!

There's a line from Piketty's "Capital And Ideology" where he talks about how much money there is in the world. I can't remember it exactly but he said something like, "There's an untold amount of wealth in the world." He was referring to I guess what we could call hidden assets - things like off-shore bank accounts.

It's been about five years since I read that book but that line (and this topic in general) has stuck with me. Thank you for shedding more light.