Capitalism Is Dying and the Empirical Data Now Proves It

So where do we go from here? Back to tyrant kings or on to communism?

Editor’s Note

This is a guest post by Ted Reese. Ted is a big bad scary Marxist. (I personally think it’s insane to put more control in the hands of sociopathic power-seekers — which is why I’m against both a dictatorship of the proletariat and the metastasizing corporatism under which we find ourselves.)

But I like Ted, and his perspectives in this article are deeply compelling. It’s heady stuff, but absolutely worth understanding. No one should mourn the loss of undemocratic capitalism. (It’s just the monopolization of private property.)

In this article, Ted makes the case for the economic necessity of socialism. Those who take the time to understand his argument will have a hard time refuting it. They’ll have an even harder time suggesting a more interesting option than what Ted calls “automated luxury communism.”

There are 8 billion people in our global family, and we’re terrible at sharing. Ted suggests there’s a better way. He might not be 100% right, but he’s definitely not wrong.

Enjoy.

— Jared A. Brock

Capitalism is dying.

There’s now empirical data that proves it.

Let’s look at the overall picture, the long-term indicators, the short-term indicators, and where that inevitably takes us.

(Hint: It’s either really bad or really good.)

Let’s dive in:

As capital accumulates, the rate of profit falls.

The evolution of production from (labour-operated) mechanisation to (supervised) automation is abolishing the source of (exchange) value and profit — the capitalist’s veiled theft/exploitation of commodity-producing labour’s labour time.

This historical process is not reversible: innovation is inherent to the nonstop nature of evolution and human activity; and capital accumulation itself demands innovation, absolutely rising productivity and cheaper-to-produce commodities in order to offset falling profitability initiated by previous expansions in production that devalue the average commodity.

Socialism, replacing private enterprise (producing commodified utilities) with social enterprise (producing decommodified utilities) is therefore becoming an economic necessity for the first time.

Long-term indicators

➤ The average global rate of profit is trending historically towards zero, having fallen from an estimated 43% in the 1870s to 17% in the 2000s and 11% in the 2010s.

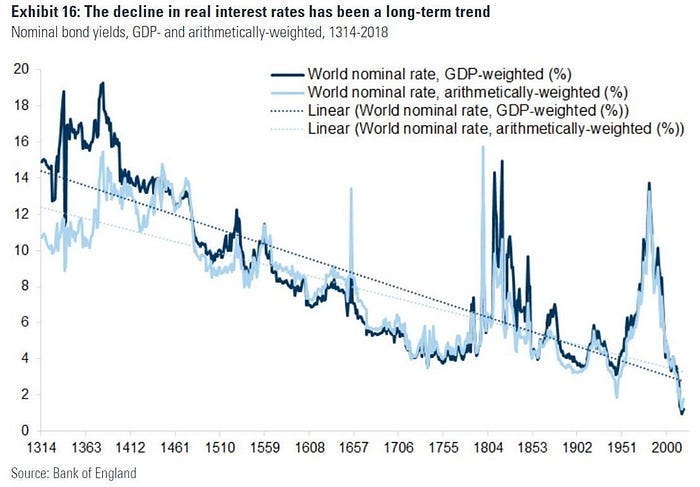

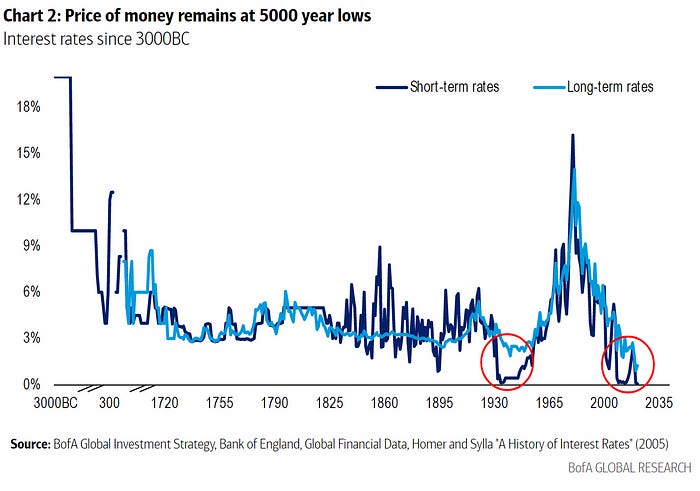

➤ Interest rates (interest being a form of profit) have trended downwards over seven centuries — 5,000 years, even — regardless of the political-banking-legal regime.

“The decrease in interest rate is a symptom of the annulment of capital only inasmuch as it is a symptom of the growing domination of capital in the process of perfecting itself — of the estrangement which is growing and therefore hastening it’s annulment.” — Karl Marx / “The rate of interest is related to the profit rate in a similar way as the market price of a commodity is to its value…. The general rate of profit, in fact, reappears in the average rate of interest as an empirical, given fact.” — Henryk Grossman

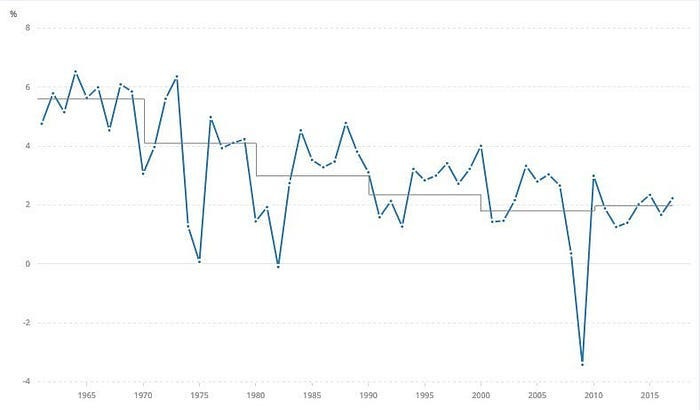

➤ GDP growth rates in ‘high income countries’ are trending towards and already closing in on zero, having averaged around 6% in the 1960s and below 2% since 2000.

➤ The post-recession recovery from the 2007–09 Global Financial Crisis (GFC) — based on unsustainable debt and a temporary shale gas revolution that peaked in 2019 — has been the weakest, relatively, since WWII.

Whereas US GDP grew by 43% over the first 39 quarters of the 1991–2001 expansion, in the first 39 quarters of the expansion up to March 2019, it grew by only 22%. At that rate, the latter would have had to continue for another six years to equal the aggregate growth of 1991–2001, and nine more to match the the 54% recorded in 1961–69.

Decade-by-decade average GDP growth rates in ‘high income countries’. Stepped line represents decade average. (Source: World Bank.)

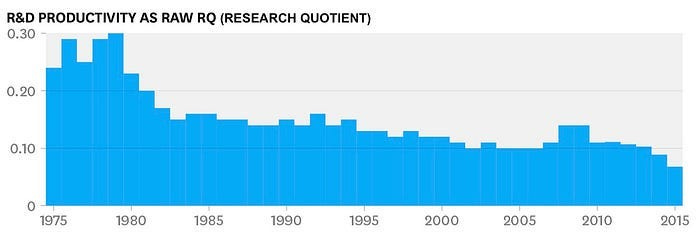

➤ The rate of productivity growth has trended downwards over the past seven decades to near-zero.

The returns on US research and development (R&D) fell during 1985–2015 by 65%, despite a 250% rise in the number of scientists and engineers engaged in R&D.

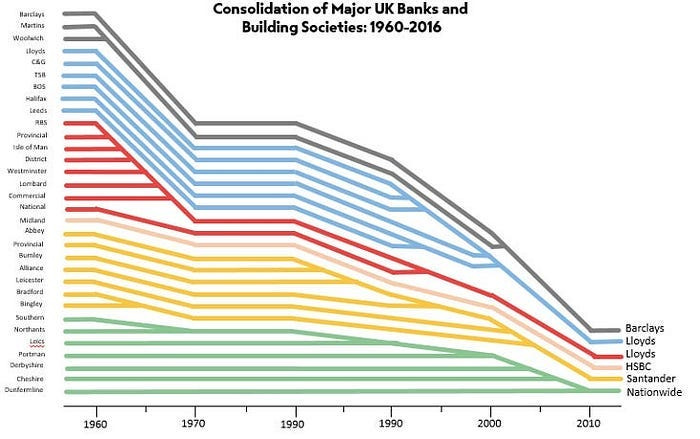

➤ Almost half, 43%, of around 9,000 commercial banks in the US disappeared between 2000 and the end of 2017 (already down from 14,000 in 1986 and 30,000 in 1921).

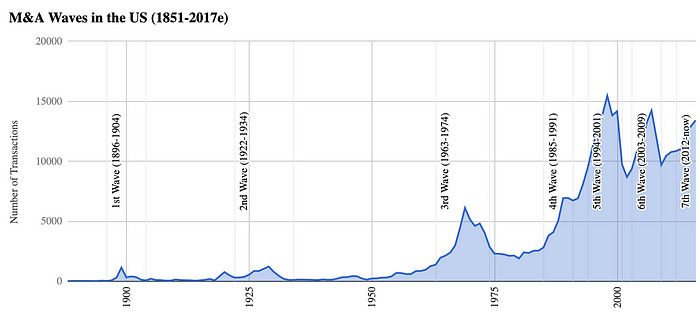

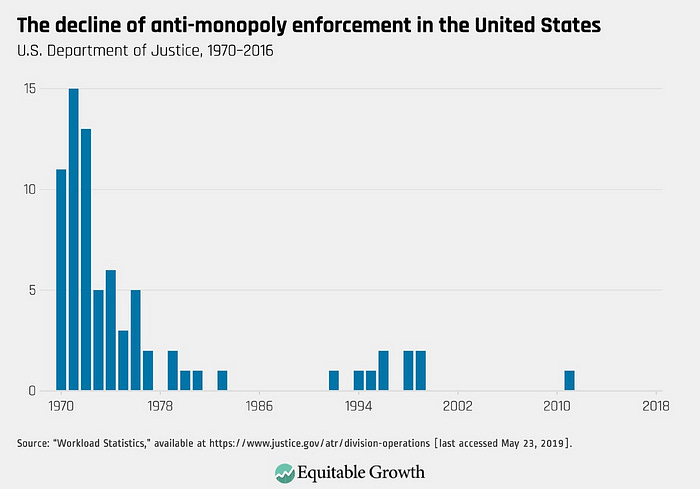

➤ The number of public US companies consolidated from 8,000 in 1996 to 4,500 in 2016 and 3,700 in 2022.

Of seven major merger and acquisition waves in the US since the 1890s, four (60%) have taken place since 1989.

In the airline sector, for example, the top four firms served 43% of the market in 1985, rising to 72% in 2017. The respective top two firms of each market command 87% of the search engine market, 69% of the wireless carriers market, and 76% of the delivery services market.

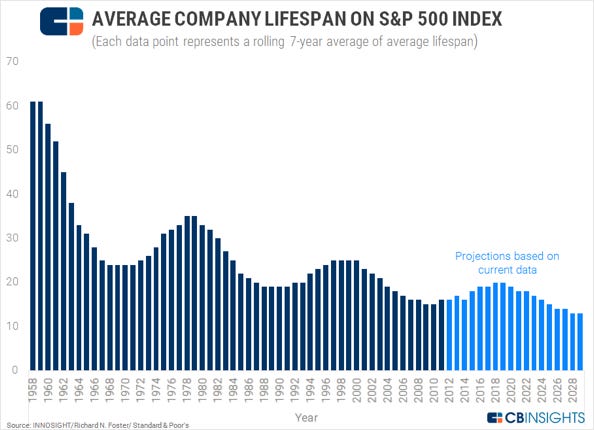

➤ Between 1964 and 2014, the average lifespan of S&P 500 companies shrank from around 60 to 18 years.

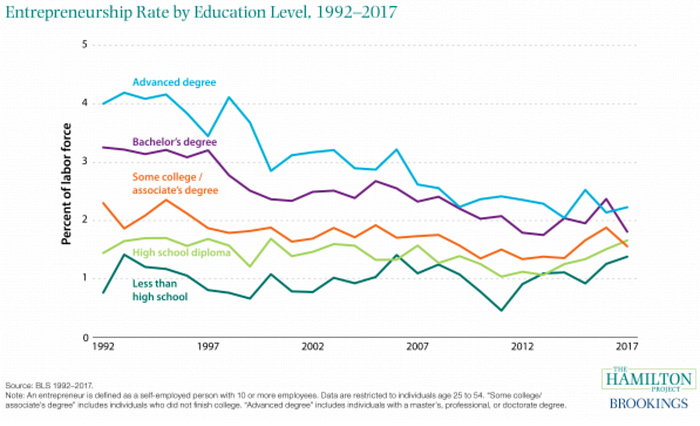

➤ From 1977 to 2013, startups as a share of all US firms fell from 16.5% to 8%, a decline pervasive across states and sectors.

Fewer than 4% of US 30-year-olds in 2013 were entrepreneurs compared with 5.4% of those born in 1965–80 and 6.7% in 1944–62. The same downward trend in entrepreneurship has taken place among older citizens of prime working age.

Share of new firms as % of total firms (Source: Census Bureau Business Dynamics)

➤ Of the roughly 750 currencies that have existed since 1700, only around 20% remain.

➤ British pound sterling has lost more than 99.5% of its purchasing power since its adoption as official currency in 1694.

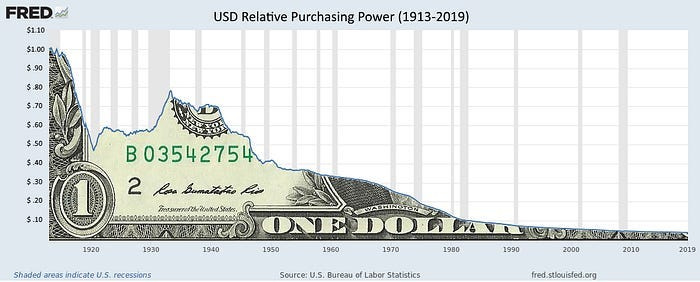

The US dollar in 2018 had lost more than 96% of its purchasing power since 1913, having barely changed in the previous 140 years when the rate of the economy’s growth (relative to its size) was much higher.

The vast amount of that figure, 91%, ensued after 1949, when the US supplanted Britain as the world’s dominant imperialist superpower.

The figure since 1970 is 85% (93.5% for Britain), around the time of the first major post-WWII recession and the start of the digital/computing/automation revolution.

Although the rate of innovation tends to slow down as the rate of profit falls, the pace of innovation tends to accelerate absolutely. Computing power tends to double every 18–24 months (Moore’s Law) and total production tends to double every 25 years, devaluing commodities as much less labour time is contained in each commodity, thereby also devaluing the money-commodity.

➤ Production costs and consumer commodity prices have therefore trended secularly/historically towards zero.

For example, whereas the world’s fastest supercomputer in 1975 was worth $5m ($32m in 2013’s money), the price of an iPhone 4 released in 2010 with the equivalent performance was $400.

Aerospace companies producing propulsion systems in 2010 for $24m in 24 months were by 2018 3-D printing their engines for $2,000 in two weeks.[1]

One gigabyte of data storage fell from $193,000 in 1980 to just $0.03 in 2014.

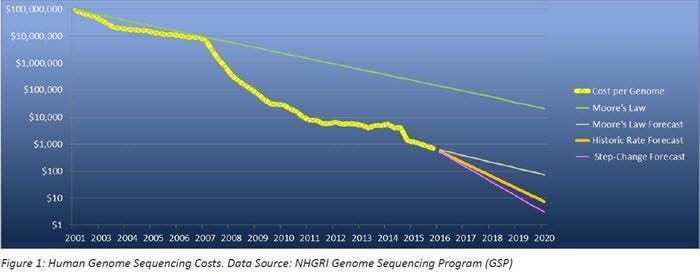

While sequencing the first human genome took 13 years and in 2001 cost $100 billion, the cost had fallen to below $1,000 by 2016 and now takes about 24 hours.

In 2000, the cost of producing one kilogram of protein through precision fermentation cost $1 million, but in 2020 the cost had fallen to around $100.

As soon as a company like Nestle starts buying its milk this way (it is already investigating viability) — as it must to rewiden its own profit margins — the conventional farming industry will become uncompetitive and unprofitable.

Rethink X also predicts total systemic collapse this decade.

➤ With deposits becoming shallower and deeper and extraction more capital-intensive (dependent on machinery relative to labour), the Energy Return on Investment (EROI) on fossil fuel has fallen from above 100:1 (a return of 100 units of energy for every 1 invested) in 1930 to around 3–6:1 in 2019.

The labour intensity (including the labour needed to produce capital-intensive extraction machinery) of fossil fuel production and its non-renewability (constantly reproducing the industry’s demand for labour) has been vital to capitalism’s overall profitability.

The ‘tight/shale oil revolution’ breathed some life into the oil industry in the 2010s but peaked in 2019.

The value of Saudi Arabia’s state assets, mainly in oil, is predicted to fall from $900bn to minus-$2trn around 2030.

In 2015, the total debt of the oil and gas sector globally stood at roughly $2.5 trillion, 250% higher than at the end of 2006.

The fossil fuel industry only remains ‘profitable’ because of its parasitic dependence on debt/public subsidies — no bottomless pit — of $16bn a day and artificial cuts to production that normally raise consumer prices by 70–80%.)

➤ Just as the number of slaves in the US declined as a percentage of the population (from approx. 25% in 1790 to 16% in 1860) before slavery ended; manufacturing workers declined as a percentage of the US workforce from 26.4% in 1970 to 8% in 2018.

Science has usurped manufacturing as the mother of production and the working class is now largely based in services instead of physical commodity production, even in South America and Sub-Saharan Africa.

Whereas the capitalist class is a relatively dwindling minority of the world population, the working class (people who’s income depends on waged employment) has grown exponentially (outmoding capitalist ‘democracy’ — which makes standing for election prohibitively expensive and excludes the working class from participating in policy-making — and, along with new technological capacities (debating and voting online), precipitating participatory socialist democracy).

Short-term indicators

➤ Trade restrictions have been hitting record levels since 2015, before Brexit and the presidency of Donald Trump.

➤ The medium real revenue growth of ‘FAANG’ stocks — Facebook, Amazon, Apple, Netflix and Google, the five best-performing American technology companies of the 2010s, comprising about 20% of the value of the S&P 500 — turned negative in 2022 for the first time.

➤ 2022 was the worst year for stocks and bonds combined since 1871. Long-term US government bonds staged the biggest drop since 1788. The classic investor blend of bonds and equities put in the worst performance since 1932.

At its lowest point in 2022, the S&P 500 index in the US had shed $11trn in market capitalisation, similar to the entire annual economic output of Germany, Japan and Canada combined.

Losses on the banking industry’s investment securities totalled $690bn in the third quarter (Q3) of 2022 — compared to less than $100bn in 2008 at the height of the GFC.

Total banking assets of $23.6trn were matched by total liabilities (money owed) of $23.6trn; but once the devaluations of face value investments as a result of rising interest rates/borrowing costs are taken into account (along with several other factors) the US banking industry as a whole was a conservatively estimated — not including exposure to hidden derivatives and cryptocurrency — $400bn short of solvency.

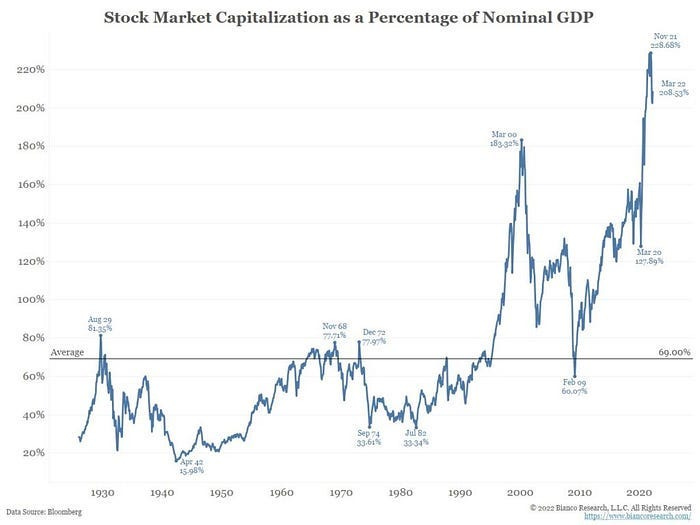

➤ A third ‘one-in-100-year’ financial bubble in three decades — the first three to surpass the bubble preceding the 1929 Wall Street Crash — engulfing the world economy has been labelled ‘the everything bubble’ (the previous two being the 2000–01 dot com bubble and the 2007–09 housing bubble) since it now encompasses every asset/debt class for the first time.

‘The everything bubble’ is the third time a global financial bubble has balooned greater in relative size than the pre-1929 bubble but the first time it has engulfed every asset class, including government bonds.

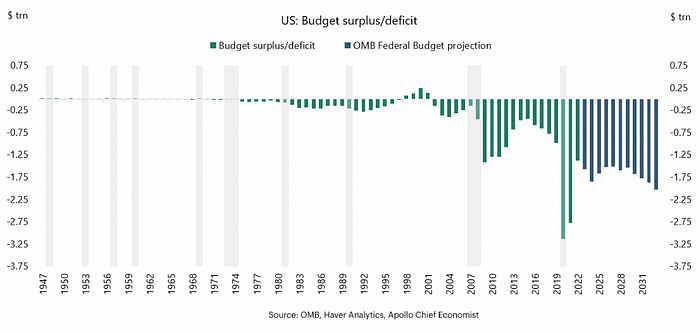

Official US national debt-to-GDP — driven by private sector debt heaped onto the backs of the public — hit an all-time high of 137.2% in 2021. The record high aggregate global debt is unsustainable since the tax base needed to repay it is shrinking in relative terms.

The actual figure has been estimated to be 2.5 times higher (as of July 2019) and 2.5 times higher than the global money supply (as of 2015, up from two times higher in 2013).

Source: Congressional Budget Office

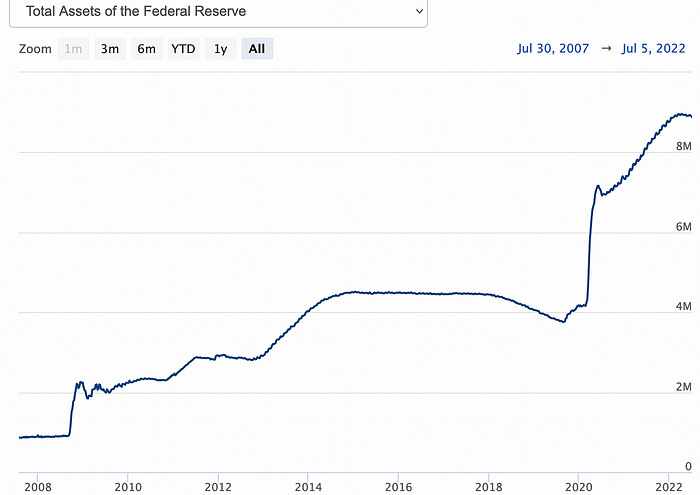

➤ To bail out private banks and private corporations (by purchasing their debt, spending the money into existence), the balance sheet of the Federal Reserve, the US central bank, rose from $900bn in September 2008, during the GFC, to $9 trillion (trn) in 2020 — an unprecedented 10-fold increase.

➤ The US’s M1 money supply (very liquid monies such as cash and traveller’s checks) rose from $1.6trn in May 2009, to $4trn in February 2020, to $16.5trn in June 2020; and $20.7trn in March 2020.

The broader M2 supply (M1 plus less liquid monies such as savings and money market funds) went from $8.4trn in June 2009 to $15.3trn in February 2020 and $22trn in April 2022.

That meant 80.7% of all M1 ever put into circulation was ‘printed’ (electronically) in just 23 months; 69.5% for M2 in 26 months.

For comparison, the total the US spent on its wars on Afghanistan, Iraq, Syria and Pakistan from 2001 to 2020 cost cost $6.4trn.

➤ Lifting the US economy out of recession has required on average since 1958 a baseline interest rate cut of 6% (in order to cheapen capital to incentivise lending and borrowing); but since the (worst ever) stock market crash in March 2020, rates were already near zero, having been cut after March 2020 from 0.75% in the UK and 1.75% in the US.

Neither country had ever gone down to 0% before 2009.

UK baseline interest rate 1800–2020. Source: Bank of England

Far from controlling the baseline interest rate and causing recessions, as claimed by right-wing libertarians, the Fed typically lowers the base rate following a decline in and in line with the yield on the 2-year Treasury, which falls with rising demand as investors without profitable opportunities seek a relative safe haven.

Bank lending tightens and *then* the Federal Reserve cuts rates, in order to cheapen capital to reincentivise borrowing and investment, to stave off or end a recession.

➤ As ‘smaller’ or poorer banks and corporations go bust or default on their debts to the central bank, the central bank balance sheet (and thus the money supply) naturally falls and so interest rates inversely rise — making new debt needed to pay off the interest on old debt more expensive, including for governments and central banks.

In 2023 the Congressional Budget Office projected that US government interest costs would grow nearly threefold from $331bn in 2021 (2% of GDP) to $910bn in 2031, from 7% to 12% of the federal budget, totalling $5.4trn over 10 years — making it the fastest growing component of the federal budget — and 45% of the federal budget in 2050 ($60trn, 9% of GDP). That’s far higher than the previous postwar peak of 19%.

➤ After more than a year of rising interest rates, at the start of 2023 the percentage change in the M2 money supply declined absolutely for the first time since the end of 1932, during ‘the Great Depression’ — from a greater relative ‘height’ and at a greater relative ‘steepness’.

From March 2021 to June 2023, the rate of M2 growth fell by 31% from its peak of 26.3%, contributing to disinflation (slowing inflation) of about 5%; compared to 12% and 10.5% actual deflation in 1932.

➤ The Fed itself started to operate at a loss in October 2022 — with its long-term assets fixed at lower rates but its short-term liabilities (money owed) burdened by rising interest rates — putting it on course to have negative tangible equity (liabilities exceeding assets) for the first time.

That meant the Treasury stopped receiving the Fed’s surpluses, a $100bn+ annual revenue source — four times the annual budget of NASA.

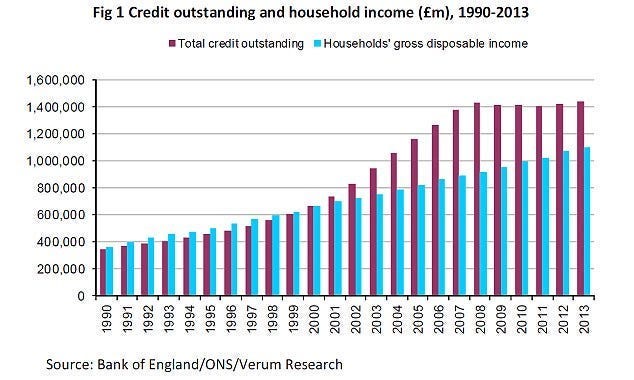

➤ It took eight years of interest rate hikes peaking at 19% in 1981 to bring down the inflation of the 1970s — lower wages relative to rising household debt levels mean interest rates of 3% in Britain in 2022 were the equivalent of 14% in 1980.

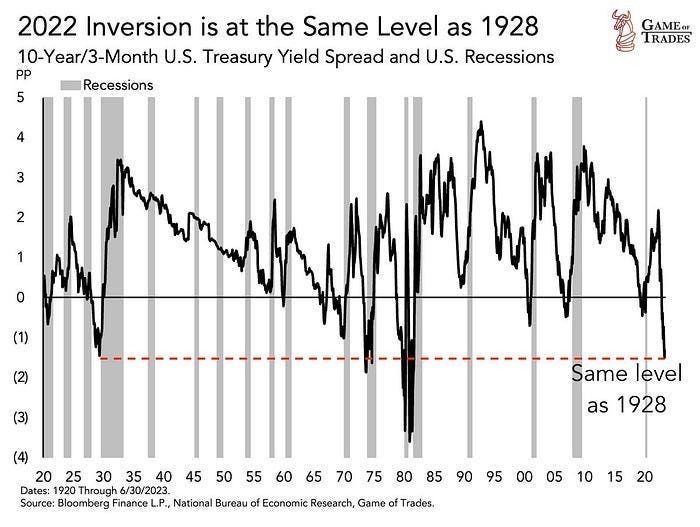

In 2019, after interest rates had crept back up from 0% over 30 months to 2.5%, the highest since early 2008, the US yield curve inverted for the first time since before the GFC.

(That is, the demand for and yield (interest/return/profit) on 10-year government bonds went lower than 2-year bonds; suggesting that the market as a whole is becoming more pessimistic about economic prospects for the near future.)

Remarkably, however, the inversion struck after the baseline interest rate had moved back down (from 2.25% to 2% at the end of July).

The remarkable kept coming: while falling share and rising bond prices in a crisis usually generate falling interest rates, on 9 March 2020 the 10-year US Treasury Bond interest rate spiked upwards — something that, according to one bond trader, statistically speaking should only happen every few millennia.

In 2022 the 10-year/3-month yield curve inversion hit the same level as in 1928 (the year preceding the Wall Street Crash which triggered the Great Depression).

➤ In October 2022 the US’s Strategic Petroleum Reserve fell to a 38-year low of 21 days of domestic demand, down from 40 in 2020. The 283 million barrels sold in 2021–2 took 25 years to accumulate. The US’s diesel reserve supply also fell to a historically low 25 days.

In August 2023, the credit rating agency Fitch downgraded the US’s credit rating, which investors use as a benchmark for judging how risky it is to lend money to a government, from AAA to AA+.

In the classic style of any declining empire, the US military is using its equipment and weapons quicker than it can reproduce them while drowning in debt and bleeding dry the tax base and other sources of income the US parasitically depends on.

The economic necessity of socialism

➤ Since private enterprise is increasingly dependent on mergers/monopolisation and long-term central planning (eliminated internal markets,[2] centralised databases, real-time stock analysis, etc.) and state (public) subsidies (including tax cuts) — trending towards 100% of income and therefore nationalisation — taking the means of production under public ownership, a ‘final merger’, and centrally planning the economy as a whole, is becoming, for the first time, an economic necessity. (A total monopoly cannot be privately owned, since there is no exchange of ownership, making ‘trade’ truly free.)

State subsidies to US businesses tripled from 1990 to 2015; collectively ring from 0.5% of business value added in 1990 to 1.4% in 2015. At the same time, the gross tax rate facing businesses declined from 4.7% of value added to 3.3%, which accounts for “the largest subsidies that are provided to firms making investments larger than $100 million” (not included in the above chart).

Capitalist competition itself leads to monopoly — primarily offseting falling profitability through expanded production and the efficiency gains of economies of scale — since the merger of two companies enables the combined force to outcompete a third competitor. Other examples: the car industry and the food industry.

➤ Since the private sector is losing its ability to employ value-creating (commodity-producing) labour — it does so only if profitable — society, via the state and state enterprises, must take over responsibility for employment, enabling actual full formal employment. (‘Full employment’ in capitalism discounts lumpenised/destitute ‘economically inactive’ workers.)

Every recession tends to result in a greater spike in unemployment.

➤ Since the workforce is now almost entirely services-based, economic stability can only be established by an applicable system, whereby value is created not by for-profit commodity-production but by break-even utility-production.

➤ Since fiat currency is dying a natural death, with cash also disappearing in relative terms — only so much cash can be stored physically; accumulation demands increasing efficiency in circulation and turnover; and cash must be converted into bonds to lower interest rates — it must be replaced by a non-transferable digital voucher system, with the ‘currency’ pegged to labour time.

Workers will therefore receive all the value they create during the working day (instead of having part of it appropriated by capitalists both at the point of production and in the form of public subsidies), paid in units of labour time worked, minus contributions to universal public services and other state expenses.

A grading system will incentivise types of work (night shifts, for example) and productivity rates. Prices will tend to fall to zero, rising only with falling demand or in extreme circumstances (such as invasions from any remaining capitalist regimes).

Combined with public ownership and full employment, this system will institutionalise equality of labour, underpinning equal rights (whereas rights under capitalism only really exist to the degree that you have money) and limiting economic inequality to a minimum; while consistently raising living standards for all (especially via general falling prices).

And since digital vouchers will be non-transferable, cancelled like train tickets once ‘spent’, the centralisation of wealth into the hands of a few becomes impossible.

➤ In the long run, as artificial intelligence, 3D-printing, lab-grown food, etc. become increasingly diffuse, localised, and personalised, the divide between producer and consumer will increasingly disappear, bringing about increasing economic independence and abundant (extremely plentiful) material wealth for all, meaning class and the state will become increasingly irrelevant; and both will therefore (continue to) wither away.

So, whereas capitalism has a long-term tendency to centralise wealth and power, socialism has a long-term tendency to decentralise wealth and power.

Essentially and historically, socialism completes what capitalism started but could not finish.

➤ Precision fermentation, 3D-printing, bioplastics, microbial fuel cells, etc., are forms of additive manufacturing — growing, replicating and layering — as opposed to subtractive manufacturing — metal or trees subtracted and shaped from mines or land, for example. So:

(Polluting, non-reciprocal) subtractive and mechanised production = limited/scarce production = capitalism

(Clean, reciprocal) additive and automated production = unlimited/abundant production = communism.

Ted Reese is a journalist, British-based Marxist, and author of Socialism or Extinction and The End of Capitalism: The Thought of Henryk Grossman. This year he is publishing Abundant Material Wealth For All: A Manifesto for the Coming World Socialist Revolution Follow Ted on Twitter and Medium and support his work here.