Bitcoin and Ethereum Are Dead (And Their Honest Investors Know It)

The $1+ trillion concept is brilliant, but it won’t end well

The $1+ trillion concept is brilliant, but it won’t end well

Update: Comments insulting my (admittedly limited) intelligence while simultaneously claiming Bitcoin isn’t a Ponzi scheme will automatically be deleted unless you also disclose your BTC+ETH holdings.

Update #2: After nearly 2,000 story responses in <24 hours, I’ve published a follow-up piece entitled People Aren’t Actually “Investing” in Cryptocurrency, They’re Just Gambling and included some of the nastiest comments. :-)

A few weeks ago, I wrote an article suggesting that people are treating cryptocurrency like a Ponzi scheme. That earlier speculators are doing their darndest to convince the world to buy in so they can cash out.

You should’ve seen the nasty messages I received from bitboys.

More negative reaction than all my other articles combined.

And that’s okay.

They’re living with sunk cost fallacy…

Irrational investment bias…

Escalation of commitment…

Modern Dutch tulip mania.

It doesn’t mean I’m wrong.

It also doesn’t mean blockchain technology isn’t brilliant.

It just depends how we use it.

Though certainly not without its risks — it’s a potential surveillance nightmare — I’m generally a fan of blockchain technology.

But a few decades from now, Bitcoin and Ethereum will be collector items, not the currency of the global economy. Here are eight reasons why:

1. It’s already old technology

Bitcoin was an absolutely ground-breaking concept when it came out, just like the Ford Model T or Edison’s incandescent lightbulb.

But the first iteration is rarely the best.

Even my mother-in-law doesn’t use Windows on a PC anymore.

Bitcoin’s proof-of-work distributed ledger is proving itself to be arcane technology compared to proof-of-stake systems. ETH is currently making the switch, but it remains to be seen if they’ll pull it off successfully. And we have no idea what future innovations will make these early coins irrelevant in the same way the iPhone crushed the home phone/wristwatch/TV/alarm clock/GPS markets.

2. People are realizing crypto isn’t a hedge against inflation

Investors are rightfully worried governments are debasing their purchasing power (they are) and that hyper-inflation is coming (it’s already here.)

But crypto isn’t a hedge against these things — it’s a speculation against them.

Making money by betting on coins requires someone else to lose money. It’s only a matter of time before the majority of speculators (the losers) will realize there are safer ways to hedge against monetary manipulation.

3. It’s expensive

People hate transaction fees.

It’s why people ditched Paypal for money transfers and moved to Wise.

As Amazon has proven in every market it’s entered, shaving profit margins to the bone is what wins in the long-run. (Because, after all, what is corporate profit but the final inefficiency?)

And let’s face it: ETH’s gas fees are absurd and BTC’s transaction fees leave plenty of room for competitors to undercut them like Walmart in nineties.

4. The bigs will do what they always do

The top 4% of hodlers own 95% of all Bitcoin.

You can’t stop the whales.

Just look at what Elon Musk is doing with BTC and Doge.

“Free”-market capitalism always ends in monopoly.

You don’t need to corner the market on BTC or ETH — with a big enough stake or a large platform, they’ll be able to repeatedly manipulate prices in their favor. Over the long run, speculators will steer clear, knowing the house always wins.

5. It’s horrible for the environment

Bitcoin is a brutal energy hog, generating 22+ million metric tons of carbon dioxide emissions per year — the equivalent of 6.7 million cars.

If Bitcoin was a country, it would be the 9th biggest electricity consumer on the planet.

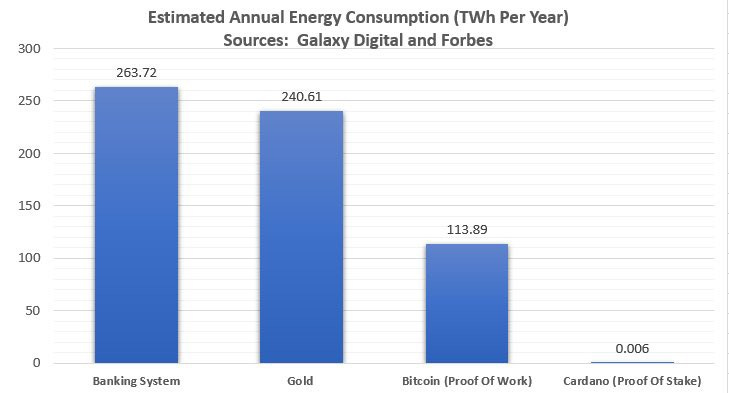

Sure, some miners use renewable energy, and to be clear, crypto-mining uses far less energy than gold mining and the traditional banking system, but until 100% of our global electricity comes from renewables, this means ESG/SRI investors are likely to steer clear.

Did you read that? 130 terawatt-hours per year.

A terawatt-hour is enough energy to run a city of 200,000 for a year.

And what do we have to show for it?

A video game.

With that kind of environmental impact, paired with whales like Elon manipulating prices, it’s only a matter of time before…

6. Governments will increase regulation and taxation

As lawmakers begin to wrap their heads around this new digital casino, they’ll see it as:

a.) Something they need to “protect” their citizens from (and you know there’s a crooked bank out there who’s lobbying for them to do just that.)

b.) A fresh source they can tap for new tax revenues. Right now, most countries tax crypto profits at a capital gains rate. Expect the introduction of corporate rates, income rates, and potentially even a transaction rate. The major question is what will happen when people start writing off their losses. Since this is a pyramid scheme and millions are bound to lose, these mathematically-inevitable write-offs could crush tax revenues and cripple social service programs. We just don’t know the long-term effects yet.

7. Altcoins will continue to eat market share

BTC was 1.0.

ETH was 2.0.

ADA (proof-of-stake) and NXS (quantum resistance) are 3.0.

Others will follow.

To be clear, Bitcoin was brilliant — and more importantly, it introduced the world to blockchain — but it’s just the start, not the end.

For the tens of millions of speculators who are only invested in crypto in hopes of striking it rich when a coin goes “to the moon,” they mostly realize that BTC’s and ETH’s biggest rises are behind them.

They’re looking for new coins to pump, ones with 100x upsides.

Expect them to look elsewhere.

8. More countries will ban BTC and ETH

I used to drink out of styrofoam cups as a kid. Then one day they disappeared. I’ve traveled to forty countries in the past decade. Aside from America, I haven’t seen a styrofoam cup since, because nations just banned them.

Crypto prices recently plummeted after China announced its Bitcoin ban.

This is just the start.

Don’t think other countries won’t follow suit, especially as they launch their own national surveillance currencies.

It will be in their best interest to make crypto trading illegal.

And remember, you don’t have to directly go after BTC and ETH to hurt them irreparably. You just need to make it illegal for your citizens to own them. You don’t have to shut down McDonald’s to cripple McDonald’s — you just have to make it illegal to eat at McDonald’s.

As we enter the age of Central Bank Digital Currencies (CBDCs — programmable and trackable surveillance money), we’ll see several hundred countries become direct competitors with BTC and ETH.

Never underestimate the violent lengths to which governments are willing to go to retain power. Bitcoin’s market cap typically hovers around a trillion dollars, and ETH somewhere around half that. The USA’s GDP is over $20+ trillion, and it’s backed by the most lethal military in human history. If crypto becomes an economic Thucydides Trap, don’t expect America (the modern Sparta) to roll over and die. In fact, don’t expect any corporate-sponsored nation to surrender. Expect them to play extremely dirty.

I have a friend who got into crypto early.

Today he owns fifty Bitcoins.

He thinks BTC will go to $20 million/coin in our lifetime.

$375 trillion market cap.

The global denomination.

There’s no point arguing with him.

He has Dutch tulip mania.

I can only hope that the next generation of speculators will forget about BTC and ETH and allocate elsewhere — ideally to real-world eco-investments that blitzscale us to 100% renewable energy, lift billions from poverty, increase real democracy, and usher in a circular economy that works for everyone and everything.

And who says those assets can’t be securitized on the blockchain?

Read Next

Dear Space-Obsessed Billionaires: Please Stop

This Real Estate Bubble Won’t Pop — In 50 Years The Average House Will Cost $10+ Million

Bitcoiners Are Desperate For One Last Pump So They Can Dump

Follow Jared on Medium and subscribe to Surviving Tomorrow.