"There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved." —Ludwig von Mises

The stock market is going to crash in the next three years and wipe out half the market.

Either that or the Feds will continue to print so much new cash to avoid a crash that your savings will be worth half their current value.

For tens of millions of zero-asset Americans, and those with the means and discipline to save for the future, these punishing scenarios amount to six of one, half-dozen of the other.

But the grifters who’ve profited wildly from the debt-fueled rise in real estate, stock, and crypto prices don’t care.

Because they’re all in on the scam.

Pretty much everyone agrees

You know the market is a fraud when share prices double or triple despite profits getting crushed by a global pandemic.

A crash is coming, it’s just a matter of when and how large.

The Economist’s Intelligence Unit thinks a bubble burst is highly probable.

Jon Wolfenbarger, of the Mises Institute, thinks this crash will be worse than 2008, dropping at least 60%.

Michael Burry (of The Big Short fame) thinks we’re in a massive bubble and the looming crash will be the worst in history.

Approximately 50% of Wall Street strategists think the S&P 500 will end the year below current levels. (Bank of America thinks -10%, Morgan Stanley thinks -20%.)

Investor John Hussman (who predicted the dot-com bubble burst) thinks the market will crash 66%.

Jeremy Grantham thinks we’re in a bubble the size of 2008 or 1929.

The European Securities and Markets Authority thinks we’re in a bubble.

Mega-criminal Warren Buffett thinks a crash is coming and has over $140 billion ready to deploy.

The top 15 non-financial companies (including Apple, Alphabet/Google, Amazon, Microsoft, and Meta/Facebook) think a crash is coming and have stockpiled more than $1 trillion to go shopping when it does.

Here are five reasons why we’re in this bubble, and why it’s going to burst:

1. Insane new investors

Kids these days.

Boomers robbed them of their future, so instead of even bothering with futile attempts to build real, productive, contributive businesses in the face of government-controlling tax-evading multinational monopolies, they decided to passively play the markets instead.

Enter commission-free predator apps like Robinhood. In the past two years, millions of young people have jumped onto these platforms and are treating the stock market like the casino it is.

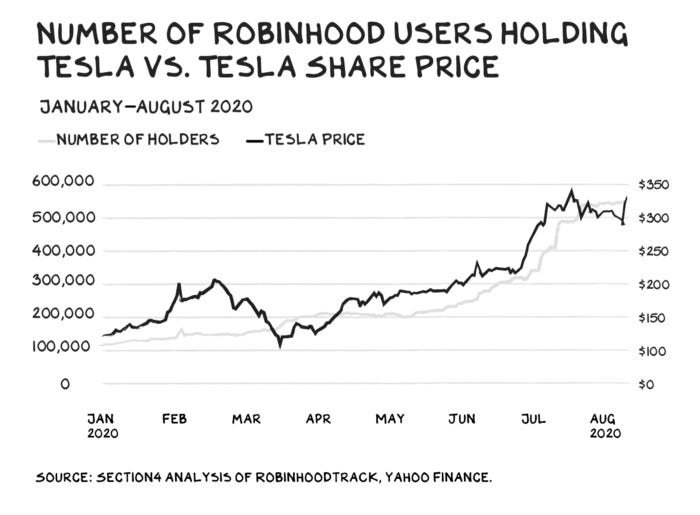

Unlike traditional value investors who pore over thousands of pages of documents in order to make sound decisions about stock purchases, young people essentially trade the news, or even mere tweets. Just look at who’s run Tesla up to a trillion dollars, even though it’s not worth 1/20th that much:

But you’ll never convince a bitboy or a Tesla maniac that meme-stonking isn’t a risky house of cards that’s bound to collapse.

After all, everyone’s an expert during a hysterics-fueled bull run.

Joe Kennedy, the infamous father of President JFK, managed to dodge the 1929 crash after having an epiphany while getting his shoes shined on Wall Street, saying:

“When even shoeshine boys are giving you stock tips, it’s time to sell.”

But rents and food prices are going up, and when this bubble does pop, all these young people won’t have jobs or free Internet money.

2. Borrow-to-invest

Why hasn’t the world learned our lesson by now?

If you let millions of people borrow money to buy the same stock…

The stock price will go up…

Which allows stockholders to borrow more money…

So they can buy more stock…

And create massive market bubbles that eventually burst and destroy millions of lives.

Easy credit is what caused the Great Depression, people.

I’ll say what no corporate-captured political party will ever tell you:

It should be illegal to invest on margin.

Especially for crypto. Thanks to DeFi, perhaps no market is as hyper-leveraged as the $3 trillion crypto market, which may have less than 10% real wealth behind it. But when people need to withdraw to pay real bills — or when the US starts heavily regulating the space — trillions will get wiped out.

3. Wild valuations

The price-to-earnings (P/E) ratio is considered the benchmark number for comparing one company’s stock price to another. The ratio is based on the current stock price divided by the trailing 12-month earnings per share. If a stock price is $10/share, and the P/E ratio is 10, it means that company is earning $1 per share. If you buy a $10 share with a P/E of 20, it’ll roughly take you 20 years to break even.

Warren Buffett likes to buy stocks with a P/E of around 12.

The S&P 500’s long-term median P/E ratio is around 15.

The S&P 500’s current P/E ratio is around 29 — nearly double its century-long average — despite the pandemic. (#Bubble)

Apple’s P/E is typically around 30.

Amazon’s P/E hovers around 60.

Tesla’s P/E ratio is currently over 330.

That’s $1 worth of earnings for every $330 invested.

Would you really buy a business with an ROI of 0.3%? Would you acquire a company that would take over three centuries to break even?

4. Inflation

When governments print trillions of dollars out of thin air and loan it to investors to pump into asset bubbles, the price of everything rises.

[Learn how to calculate your personal inflation rate here.]

When prices rise rapidly, people starve, freeze, go bankrupt, or take to the streets demanding change. That’s how Hitler came to power in Germany.

When inflation soars due to price rises due to money printing, governments have two choices:

A. Raise interest rates and likely trigger panic and a crash that lobs 50+% off the market in the next five years.

B. Print more money out of thin air to keep the bubble inflating, but in doing so, robbing the poor of 50+% of their purchasing power in the next five years.

So far, corporate-controlled governments have chosen option B, but are now signaling that they desperately need to raise rates to slow down inflation.

However, there’s no way their banker bosses will let them raise rates nearly as much as is needed to save the currency from depreciating.

But if they keep robbing the poor via inflation, there will soon be mobs in the streets. Which also tends to crash markets…

5. Everything else

There are a ton of other factors that could lead to a huge market crash:

A worsening USA-Ch!na relationship

A terrorist attack

New Covid variants (and over-responses from increasingly authoritarian governments)

A major cyber-attack

Social unrest and protests

Supply chain disruptions

Extreme weather events

Contested elections and capitol battles on a scale we haven’t seen since 1812

Typically, one of these factors will set off a chain reaction that takes down the whole market.

Remember: The dot-com bubble shaved 49% off of people’s investments, and the S&P 500 dropped 57% in 2008 and millions lost their jobs and homes. The next crash will almost certainly be far worse, by many trillions.

But the average house, stock, and crypto investor already knows all this… and they still don’t care.

Hot potato

The game is simple.

The birthday boy or girl starts with a beanbag or a balloon or a ball or — if you want a visit from child protection services — an actual piping hot potato.

Mom or dad hits play on the music and the kids toss the scalding object around the circle, hoping not to be holding the tuber when the music stops.

The music stops. Rory the fat kid gingerly holds the burning potato. All the other kids scream with delight as he’s eliminated. This repeats until one kid is left and gets a grab-bag of sugar for his or her efforts.

Adult speculators are the same way.

They all know that houses, stocks, and crypto are overpriced. They know we’re in a hysteria-driven bubble. They’re holding on as long as they can, trying to squeeze as much unearned wealth out of society as possible. But unlike 2008, they think they’ll be smart enough to sell right before the crash this time.

But they won’t (and mathematically can’t.)

Only one kid will be left with the spoils.

And it won’t be you.

Just like hot potato, the vast majority will get burned and end up with nothing in the end.